Over the past year, a large part of society has become convinced of how important it is to follow new technology, which nowadays is undoubtedly an essential element in our everyday lives. All innovations make it possible, above all, to streamline many processes while at the same time automating our existing activities. However, when it comes to taxation, it is worth noting that not only is the current tax system not efficient enough, but it is also noticeable that it does not follow the current technological trends, which could eliminate any inconveniences in the taxation sector.

Over the last few years, the possibility of using blockchain technology in the tax industry has been noticed, which could potentially help modify the current system while providing a number of benefits not only to public authorities, but also to taxpayers or even tax advisors. It should be noted that prototypes and research are being developed in specific tax sectors that could improve the efficiency of the work of, among others, tax authorities, whose actions and formal processes could be accelerated and simplifies, as indicated.

In short – what is blockchain?

In order to understand the very potential behind blockchain technology in combination with the tax area, it is first necessary to explain the specific way in which it works and to isolate its most important issues.

Referring to the technical definition, blockchain is defined as a database that consists of a decentralized registry, which means that there is no one specific entity monitoring the activities of a given system. Resources are transferred between users without any intermediary. It is based on cryptographic data, which is the main source of reliability of data transferred over the network.

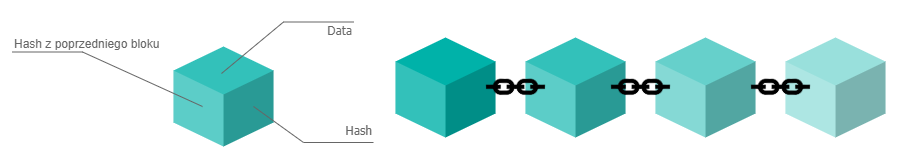

The basic element of this technology to be distinguished is the block, which is a guarantee of security due to the impossibility of modifying data. Thank to its construction, any risks of data manipulation is minimized. The block here extracts a so-called hash connecting a number of previous blocks and is also called a digital fingerprint for a reason, which is to confirm that it is impossible to create identical blocks. To give more insight into the above, the structure of a data block is shown below.

It should also be mentioned that each of the blocks stores an exact record of the information that is made through the network. Thus, in the case of cash transactions, it will be the time, data or amount of money, while in relation to the monitoring of the possible delivery of goods through blockchain, it is possible to obtain information on the entire route of the product, from the moment of its production to the moment of its appearance on shop shelves. However, translating this possibility into the area of taxation, it should be noted that such transparency of data on each stage of the transport of a product may help to identify at an early stage, for example, the carousel fraud, which is known to use transport companies for their illegal activities. This, however, may give rise to resistance to the implementation of this type of system for monitoring the circulation of goods subject to VAT – as it deprives the treasury of source of tax revenue from check made years after the transactions took place. In an ideal state, of course, all parties i.e. authorities and taxpayers, would be interested in introducing such solutions, if only because they ensure transparency and ongoing control. In a state, however, where many regulations are still written for control purposes and intentionally in an unclear manner, an instrument eliminating the possibility of even ‘growing interest’ would not necessarily gain approval.

Main features of blockchain technology

In order to truly reflect the range of possibilities for the use of blockchain technology, it is important to highlight its characteristic, which could potentially bring the issue of its use in the tax system closer.

The first feature is, first of all, decentralization, which ensures that data does not have to be stores in one central server, while having a distributed database. In practice, this means that the network is less vulnerable to possible data manipulation or hacking due to its characteristics of not having a central point.

The second feature is precision due to the automation of the system. In this case, human mistake is minimized and there is little human intervention in the data verification process.

There is also no denying the efficiency and functioning of the network – regardless of time and place. When making possible transactions via blockchain, there is no time limit or dependence on payments having to be posted at their own fixed sessions, as is the case with transfers via banks. Here, payments can be made continuously, so a major advantage is noted here for possible cross-border transactions.

Tax system and blockchain

Moving on to the main issue – the possibility of using blockchain technology in the tax system. We cannot fail to mention that, in this matter, projects, prototypes and research are being carried out at the moment. The current tax system is not efficient enough and any verified transactions by tax authorities or the obligation to complete all formalities often entails complicated actions on the part of the taxpayer or the authority, and unclear tax regulations often do not speed up these actions.

However, when referring to future developments in this regard, it is worth referring to the discussion at the Davos Economic Forum, which already took place in 2016 and the prospects already seemed promising. Among other things, the issue of implementing blockchain into the tax area was mentioned there. Among respondents asked about the potential timing of possible steps to implement the technology into the tax system, an overwhelming majority of them pointed to the period between 2023 and 2025.

Processing of tax payments

It should be noted that due to the features of blockchain, the scheme of current tax settlements, their collection and even refund could be not only simplified, but above al used in a transparent manner. The development of a system based on blockchain would help to record each tax payment, which would be fully transparent for the tax authority, and the arrears of possible underpayment would be verified on an ongoing basis.

The possibility of processing tax payments via blockchain could apply to all taxes, starting with VAT (which have a significant role from the perspective of the state budget), up to excise duty. It is therefore worth noting that the main benefit that tax authorities in this regard could gain is the real prospect of tightening the tax system.

Transfer pricing

Currently, the inconveniences associated with the transfer pricing system process manifest themselves, among other things, in the complexity of the process and the need to communicate with various departments. Such a multifaceted activity is not only time-consuming, but, above all, may encounter a certain amount of misinformation, all the more so if we are talking about transactions between related parties, which cover a global area. It is worth mentioning that in each country there are different regulations on transfer pricing, which means that there are no uniform rules on how to document them. This does not mean, however, that certain set of repetitive data cannot be specified, which may be of interest to all tax authorities.

By implementing blockchain technology, the process related to transfer pricing could above all be simplified. Through smart contracts it would be possible to establish uniform rules in the area of transfer pricing. Moreover, given the main feature of blockchain, it would be not possible to modify and manipulate the data presented so far.

What does DICE have to do with the VIES system?

DICE (Digital Invoice Customs Exchange), is an international system project developing an invoice exchange scheme. The entire system would be based on blockchain technology, while ensuring the authenticity of transactions and their reflections in real time. The system would allow the exchange of invoices with appropriate encryption and simultaneous exchange between the recipient and the buyer. A system developed in this way could certainly be one of the means of preventing tax avoidance, including ‘missing trader’ fraud while at the same time allowing the tax authorities to reacts quickly to suspicious commercial transactions.

What does DICE have in common with the current VIES (VAT Information Exchange System)? First of all, it could be an improved version of the system, which would introduce improvements in the timing and quality of information exchanged between entities. Note that, the current VIES system suffers from number of problems including, i.e. its dependence on the request of an entity. This means that when an entity decides to verify a transactions, it must rely on information provided by third parties. Importantly, the current system is not transparent and you have to wait for the final report. As we know, time is of the essence, so waiting a long time for verification is problematic from the point of view of efficiency. This problem is opposed by blockchain technology, which allows access to data in real time, thus guaranteeing a rapid response to suspicious transactions or entities.

Conclusions

So, is it possible to apply blockchain technology to the tax system? Definitely yes. Undoubtedly, blockchain technology could not only help to revolutionize the existing tax area, but most importantly, it would allow to minimize the existing disadvantages of this system. As can be seen from the above, both sides of the tax system would benefit – both taxpayers and tax creditors, but not necessarily those managing the system. As explained above, current control is not in the interest of many representatives of the fiscal authorities. If all irregularities were detected on an ongoing basis, this practically eliminates the possibility of charging interest for late payment and many other tax sanctions.

The philosophy of the tax system in Poland, which results from the approach to the creation of regulations (unclear, so-called ‘under control’), as well as to the aforementioned carousel fraud and other popular topics of control (‘growing interest’ and not looking for real tax evaders) may cause a lack of interest in the implementation of blockchain in taxes. It would suddenly increase the certainty of the tax system while limiting administrative discretion. However, it is important to bear in mind that any system modifications must be backed up by proper research to be sure that implementing blockchain in such a serious area will bring us only benefits.