The SLIM VAT package introduced in the new year contains significant changes in several levels of the provisions of the VAT Act. Also, one of these problems was the subject of the KIS interpretation issued on the basis of the following facts: The company purchased construction services, in principle covered by the split payment mechanism from Annex 15 to the VAT Act. The value of such services usually exceeded PLN 15,000. However, an advance invoice appeared that was for a lower amount. Therefore, the company was of the opinion that it does not matter what the value of the invoice is, and it is important that the entire transaction exceeds PLN 15,000 and it requires marking the SPM in the new JPK_V7.

The director of KIS noticed that general rules apply to advance invoices and that what matters is the value of the invoice, not the value of the transaction. Therefore, the split payment mechanism is not used for this advance invoice, and consequently the entrepreneur will not mark it with SPM in the SAF-T. (Individual interpretation of the director of KIS of December 14, reference number 0114-KDIP1-1.4012.659.2020.1.RR). The taxpayer’s argumentation would of course be fully confirmed if it was not an advance invoice, but a standard one. In addition, it should be noted that advances under the split payment mechanism are not covered by the collective payment scheme. Therefore, it should be stated that in the case of advance invoices, the indicator of whether or not the split payment mechanism is used is the value of the invoice issued.

Let’s explain, then, what are the principles of settling advance invoices mentioned by the Director of KIS:

A advanced payment or prepayment is a certain amount of money paid towards the future delivery of goods or services. Tax obligation in accordance with Art. 19a paragraph. 8 arises upon receipt of the advance payment. That is, the supplier, receiving part of the payment, before finalizing the delivery, must show each such payment in the declaration in the month in which he received the advance. Such an obligation does not arise for the provision of electricity, heat or cooling energy and line gas services, the provision of rental, leasing or similar services, the provision of telecommunications services, the provision of personal security services, and security, supervision and property storage services. There is a special moment when the tax obligation arises for the indicated activities, which generally arises on the date of issuing the invoice

It is worth mentioning that the advance payment for the intra-Community acquisition of goods does not create a tax obligation. This was confirmed by the Director of the National Tax Information in the individual ruling of 23 October 2020, ref. No. 0114-KDIP1-2.4012.357.2020.1.PC. “At the same time, the provisions of the Act, defining the moment when the tax obligation arises for intra-Community acquisition of goods, in no way bind it with the advance payment for the delivery of goods”

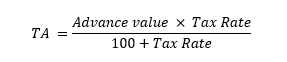

The obligatory elements included in the advance invoice are listed in Art. 106f of the VAT Act. In addition to the standard elements included in a traditional invoice, you must additionally indicate the received amount of the advance and the calculated amount of tax using the formula

tax amount = (value of the advance payment received x tax rate) / (100 + tax rate)

The final invoice is therefore fully dependent on previous advance invoices. A final invoice must be issued if the advance invoices did not represent the full value of the delivery. In addition, such invoice should contain the numbers of the advance invoices relating to it.

Returning to the subject of the Split Payment Mechanism, the SLIM VAT package also amended Art. 108a section 1a. The original provision referred to Art. 19 point 2 of the Entrepreneurs’ Law, which stipulated the amount of PLN 15 thousand for which it was necessary to use a split payment. It was not clear whether it was equal to PLN 15,000 or above this amount.

And this is the current wording of the provision:

When making payments for purchased goods or services listed in Appendix No. 15 to the Act, documented by an invoice in which the total amount due exceeds the amount of PLN 15,000 or its equivalent expressed in a foreign currency, taxpayers shall be obliged to apply the split payment mechanism. When converting amounts expressed in foreign currencies into zlotys, the rules for converting amounts used to determine the taxable amount shall apply.

It seems that there is now no longer any doubt in this regard, and this is also the rationale behind this draft. What is more important in connection with this change, however, is the extension of the subjective scope of the obligatory split payment. Previously, reference to the provisions of the Business Law meant that foreign taxpayers of Polish VAT who were not entrepreneurs within the meaning of this law were not subject to this obligation (the definition of an entrepreneur differs in scope from Article 15(2) of the VAT Act). Now, however, it is the specific amount, and not the status of an entrepreneur, that will prevail.