- Share of renewable energy in the EU countries

- The key judgment of the Constitutional Tribunal on real estate tax on wind farms

- Loosening the 10h rule in wind farms

- Responsibilities related to the production and consumption of energy – prosumer

- NSA – photovoltaic assembly was not covered by the reverse charge

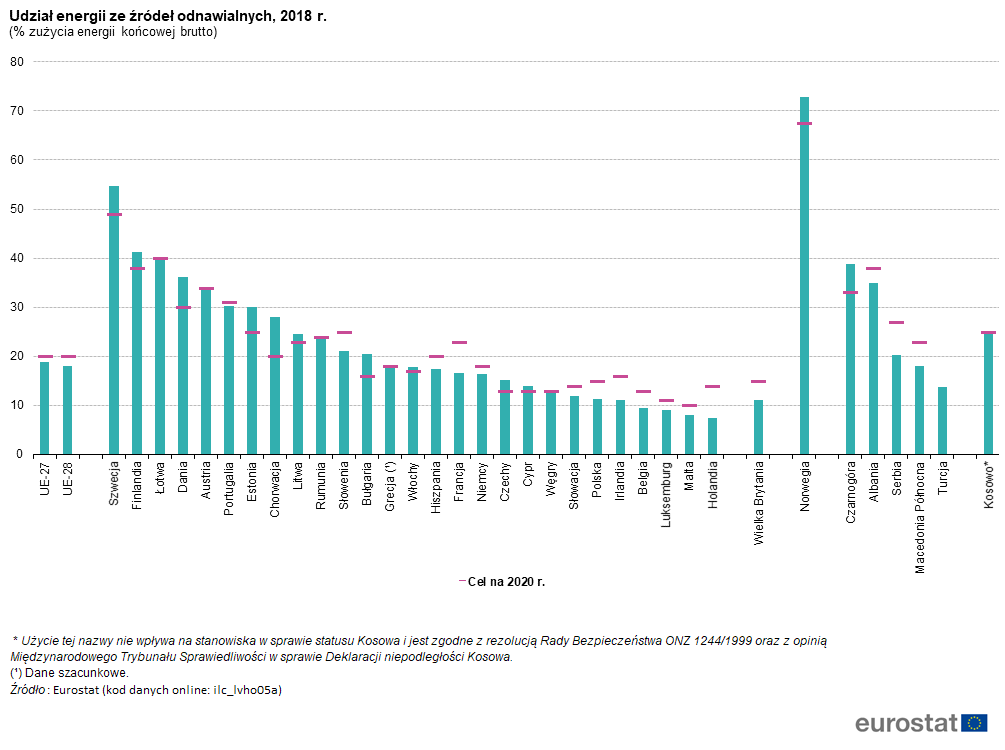

1. Share of renewable energy in the EU countries

In May 2020, the European Statistical Office issued a report which presents the percentage share of renewable energy in relation to gross final energy consumption.

The goal is very ambitious – it is assumed that Europe will be the first continent able to boast of climate neutrality by 2050. The European Union seems to be very supportive to investors on these issues, which has resulted in a positive upward trend in recent years.

Meanwhile, Eurostat has presented a report on the achievement of goals for 2018. The current target for 2020 is 20% for individual countries. As can be seen from the chart below, some countries are still very much missing and will require additional investments – the Netherlands (7.4%), Malta (8.0%), Luxembourg (9.1%).

In 2018, the share of renewables in gross final energy consumption in the EU averaged 18.9%, compared to 9.6% in 2004, which is a positive surprise. Unfortunately, Poland is in the second half of the chart with a share of 11.3%, which means that we are missing almost 8 percentage points before reaching the EU average.

In conclusion, Norway is the best in Europe in terms of renewable energy. Nevertheless, when we look at the EU countries, Sweden ranks first, with a share of nearly 55% of energy from renewable sources to the total energy used. Thus, it has a significant advantage over other countries: Finland (41.2%), Latvia (40.3%), Denmark (36.1%) and Austria (33.4%). It is also clear from the report that the largest percentage comes from wind energy.

2. The key judgment of the Constitutional Tribunal on real estate tax on wind farms

On July 22, 2020, the Constitutional Tribunal issued a ruling on wind farms and the basis for calculating real estate tax (file No. K 4/19). It is about a retroactive amendment to the RES Act, which took place on June 7, 2018, and the provision was in force from January 1, 2018.

The change concerned the fundamental definition of a structure and a wind farm. After this amendment, the municipalities resumed the collection of property tax only on the construction parts of the wind farm, and not on the entire value of the power plant. As the change of the content of these definitions had a real impact on the amount of the tax base, it meant a return to lower taxation of windmills and lower revenues of communes.

In the above case, the communes justified their argument with lower incomes and, as a result, deterioration of the quality of life of the inhabitants. The Constitutional Tribunal agreed with such argumentation, confirming the emergence – in connection with the amendment – of negative financial consequences for municipalities.

The Tribunal explained that communes should build the future budget on the basis of revenues shaped similar to those in 2017, based on primary regulations. On the other hand, the legislator could introduce such provisions earlier in order to avoid the negative consequences suffered by communes when returning to entrepreneurs a significant part of the real estate tax.

The Constitutional Tribunal found the change of the definition of a building unconstitutional. Now it is up to the legislator to worry about how to compensate municipalities for the losses incurred and how to fulfill the obligation to bring the regulation into line with the Constitution. At the same time, it should be emphasized that the amendment of the regulation in question, in connection with its recognition as unconstitutional, should be carried out in such a way as not to violate the principle of the rule of law, applicable for entrepreneurs (wind farm owners).

3. Loosening the 10h rule in wind farms

An investor who wants to invest his money in energy from wind farms must carefully analyze the act of May 20, 2016 on investments in wind farms. This legislation is a set of guidelines and regulations for this innovative industry.

Art. 4 clearly states the distance and location of wind farms. In the current dimension, the distance from the windmill location is to be equal to or greater than ten times the height of the wind turbine measured from the ground level to the highest point of the structure. This recipe is the well-known “10h rule” that freezes future investments more and more. This general rule was to protect the health of the inhabitants of nearby houses.

The above 10h rule is likely to remain as it is, but there are plans to introduce a few exceptions. Among other things, a situation in which all residents agree to build windmills at a distance closer than that resulting from the 10h rule. It is also not excluded to establish a minimum distance of 500 meters

The Court of Justice of the European Union in judgment ref. C-727/17 challenged this rule, but did not give a clear alternative answer. Certainly, a negative impact on future investments was noticed, of which there are much less windmills. Fundamentally, national laws must be proportionate and necessary to be compatible with the EU. An ambiguous judgment of the CJEU may accelerate the government’s action on the revision of the 10h rule. However, it must be remembered that this topic has been taken up in vain many times.

4. Responsibilities related to the production and consumption of energy – prosumer

On February 18, 2020, the Director of the National Tax Information received a request for an individual tax ruling (reference number 0111-KDIB3-3.4013.33.2020.1.PJ) regarding excise tax regulations and obligations related to energy generation and consumption.

In the actual state of affairs, the company declared that it had set up a photovoltaic installation as a prosumer, i.e. an entity that generates electricity and uses it for its own needs. The remaining surplus energy is stored by the energy company and settled in the form of discounts. There is no provision in the contract that would prove the resale of surplus energy. The company does not have a license to generate, transmit, distribute or trade in electricity, and its main activity is not electricity production.

In line with the above facts, two questions were asked to the Director of the NSS. Firstly, will the company be obliged to submit excise tax returns despite the exemption for micro-installations and, secondly, will it have to keep quantitative records of the generated energy? In support of the above questions, it was argued that the applicant did not hold any energy production and trading license. Moreover, the company, referring to the regulation of excise duty exemptions, also did not find a position in which it would supplement the declarations. As for the second question, it was also believed that there was an exemption from keeping records, as the sale of this energy was to be handled by the company collecting the surplus.

The Director of the National Tax Information did not agree with such statements. The release of electricity to an entity with which the company has a contract should be invoiced, and pursuant to art. 24 sec. 1 of the Excise Duty Act, declarations should be submitted without being summoned to the competent tax office. The activity will be taxed on the sale of electricity to the end customer or the consumption of electricity by the entity that produced the energy, even without a license.

At the same time, in a situation where it will supply the generated surplus electricity to the installations connected and cooperating with each other, used to transmit this energy, the Applicant will be obliged to keep the records referred to in Art. 138h of the act. Quantitative records in the absence of measuring devices require recording and determination of estimated quantities.

5. NSA – photovoltaic assembly was not covered by the reverse charge

An unprecedented judgment for municipalities that encourage investment in renewable energy sources, more specifically in photovoltaic panels. The ruling of the Supreme Administrative Court of February 12, 2020 (file reference number I FSK 1266/19) is a completely new approach to the activities of municipalities in this area.

Until recently, the position of the tax authorities was that the commune is acting as the general contractor. This meant that the assembly of panels, performed by subcontractors, should be subject to the reverse charge mechanism. This understanding was used until recently, because this legal status was in effect until the end of October 2019, when the reverse charge was in place, and it was replaced by a split payment.

The facts were as follows. The commune bought the necessary components from European funds, and then commissioned companies to install them on the residents’ buildings, and after the service was completed, an invoice was issued. The KIS director explained in the interpretation that such action is subject to the reverse charge mechanism, and the commune acts as the general contractor. The commune presented a different position, which was important in the context of the application of the reverse charge mechanism.

The case first went to the Provincial Court in Lublin, where the facts were put in order: the commune acts as the investor, and the residents are the final beneficiaries of the investment. The companies assembling the installations are not a subcontractor in this case.

The Supreme Administrative Court confirmed the position of the Provincial Administrative Court in Lublin regarding the investor’s role of the commune, however, according to the Supreme Administrative Court, the residents are not the beneficiaries of the investment. The purchase was made in full to the account of the commune. Therefore, it is not possible to apply reverse charge, and invoices should be issued by assembly companies with VAT. Consequently, the commune was entitled to deduct the tax.