1. Who is obliged to pay PPK contributions from November 2020?

The obligation of PPK will cover the so-called 3rd tranche, ie employers employing at least 20 people according to as of December 31, 2019 and also Employers who, according to 2019, they employed at least 50 employees, but due to the coronavirus epidemic, they have not decided to introduce Employee Capital Plans from April 2020 (in the 2nd tranche).

2. What are the deadlines for introducing PPK in the company?

As of July 1, 2020, the employers listed in point 1 were automatically included in the government pension scheme. These employers are required to perform specific tasks:

- by 27.10.2020 at the latest. sign a PPK management contract with a financial institution

- by November 10, 2020 at the latest. sign an agreement on running a PPK with a financial institution

3. How should the employer choose a company that will manage employee funds?

The choice of the financial institution should be agreed by the Employer with the trade union organization operating in the workplace or with the employee representation selected from among the employees. The employer may not select the institution managing the PPK funds unilaterally.

The list of institutions that have been entered in the PPK records and offer management of funds accumulated in the PPK, along with their offer, is available on the PPK Portal www.mojeppk.pl

The employer signs a PPK management contract with a selected financial institution, which should be concluded in electronic form, no later than 10 days before the deadline for concluding a PPK contract.

4. Rules for participation in the PPK

The employer makes payments to the PPK only for employed persons, i.e. for employees and natural persons over 18 years of age, working under an agency contract or contract of mandate or other contract for the provision of services, e.g. management contracts and members of supervisory boards; if these persons are subject to compulsory retirement and disability pension insurance.

The possibility of concluding a PPK contract depends on the age of the employed person and is as follows:

5. What is the amount of contributions to the PPK and when should they be transferred to the financial institution?

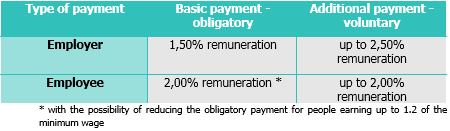

The employer and employee, as a participant in the Employee Capital Plans, finance the basic contributions from their own resources. In addition, both the Employee and the Employer may decide to make additional contributions.

6. Are contributions to the PPK a contributory and taxable income?

The amount of the contribution to the PPK financed by the Employer is not included in the basis for compulsory insurance contributions in ZUS. However, it is taxable income. Income will arise from both the basic and voluntary contributions financed by the employing entity.

7. Activities required to implement the PPK

If you have any questions, we are at your disposal:

Paulina Marcula, pmarcula@advicero.eu – HR & payroll issues

Aneta Bugalska, abugalska@advicero.eu – accounting & payroll issues

Katarzyna Klimkiewicz-Deplano, kklimkiewicz@advcero.eu – Tax Advisory & Global Mobility Tax Services